Introduction

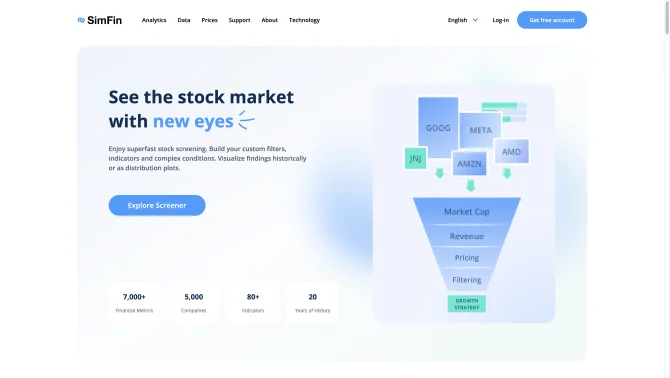

SimFin is a cutting-edge stock analysis software and data download platform that provides advanced tools for financial insights. It is designed to assist savvy analysts in optimizing investment strategies by offering a range of features including stock screening, backtesting, and access to financial data of over 5,000 stocks. With a user-friendly interface and a robust set of functionalities, SimFin is a trusted platform for investment research, academic studies, and corporate analysis.

background

SimFin Analytics GmbH, based in Halle (Saale), Germany, has developed SimFin as a platform that stands out in the financial analysis space. The company has built a reputation for its responsive team and high-quality data, which has been instrumental in the platform's success and adoption by thousands of analysts worldwide.

Features of SimFin

Stock Screening

SimFin allows users to screen stocks with custom-built conditions and values, utilizing renowned indicators to filter through thousands of stocks.

Backtesting

Users can backtest their investment strategies against 20 years of financial history, ensuring their strategies are robust and historically validated.

Historical Data Visualization

The platform provides dynamic visualization of historical financial data, enabling users to create line charts, distribution charts, and scatter plots.

Custom Metrics

SimFin enables the creation of custom metrics and the comparison of industry and regional averages for in-depth analysis.

API Access

Data can be accessed via API, allowing for integration with other tools and platforms, and supporting Python and Excel plugins for seamless data manipulation.

Data Quality

SimFin is known for its high-quality financial data, which is essential for accurate and reliable analysis.

User-defined Criteria

Users can define their own rating score criteria and weights, personalizing the analysis to fit their unique investment philosophies.

How to use SimFin?

SimFin offers a series of interactive tutorials that guide users through its functionalities, from basic operations to advanced topics like data resampling, growth and return calculations, and the construction of stock filters. These tutorials are presented in Jupyter Notebook format, allowing for easy local execution or online operation in environments like Google Colab.

Innovative Features of SimFin

SimFin's innovation lies in its ability to provide a comprehensive, yet user-friendly platform for financial data analysis. Its open-source nature and compatibility with cloud platforms like Google Colab, along with its intuitive Python API, make it accessible to a wide range of users from novices to experts.

FAQ about SimFin

- How do I start using SimFin?

- You can sign up for a free account at https://app.simfin.com/login?subscription=free and begin exploring the platform's features.

- What is the pricing structure for SimFin?

- Pricing details can be found at https://www.simfin.com/en/prices, offering a range of plans to suit different needs from individual investors to institutions.

- How can I access historical financial data?

- Historical financial data can be accessed and downloaded through SimFin's user interface or via the API for further analysis.

- Is there support for using SimFin with Excel?

- Yes, SimFin offers an Excel plugin that allows for easy data manipulation and analysis within the familiar Excel environment.

- What kind of customer support does SimFin offer?

- SimFin provides responsive customer support, which can be reached through the contact page at https://www.simfin.com/en/contact/.

- Can I use SimFin for academic research?

- Absolutely, SimFin's comprehensive data and analysis tools make it suitable for empirical research and model validation in academic settings.

- How do I ensure data accuracy when using SimFin?

- SimFin is known for its high data quality, ensuring that the information used for analysis is reliable and up-to-date.

- Is there a community or forum for SimFin users?

- While not explicitly mentioned, the open-source nature of SimFin suggests an active community likely exists, especially on platforms like GitHub.

Usage Scenarios of SimFin

Academic Research

SimFin is used for empirical studies and financial model validation in academic settings.

Investment Analysis

Investors use SimFin to analyze company financials and make informed investment decisions.

Corporate Strategy

Corporations use SimFin to monitor the financial health of competitors and inform strategic planning.

Educational Training

SimFin serves as a tool for teaching financial data analysis, allowing students to practice with real-world data.

Personal Investing

Individual investors use SimFin to perform their own analysis of financial fundamentals and optimize their investment portfolios.

User Feedback

We are using SimFin for our own application. The team is very responsive and data quality is very good.

I'm using SimFin for a personal project: predicting stock market returns with machine learning. SimFin has a wealth of data to experiment with and train models on!

Data quality is high, servers are super stable (2-3 days off during my 2 year membership), instant support, incredible price. Absolute no-brainer for me. Thanks so much, enables me to do much better personal investments.

SimFin is a great place to get reliable and updated data on the fundamentals. Perfect for anybody that wants to do their own analysis of data. Would love to see the Swedish stock market data covered in the future. Thank you for a great service.

others

SimFin is recognized for its innovative approach to financial data analysis, offering a seamless experience from data retrieval to complex analysis. It stands out with its commitment to providing high-quality data and a robust set of tools that cater to both novice and expert users.

Useful Links

Below are the product-related links, I hope they are helpful to you.